During the 1980s, the world entered the computer age, where PCs began to play a more prominent role in homes and workplaces. Like with any new technology, there were a number of sceptical individuals. A number of people felt that the introduction of computers contributed to societies move towards a complete surveillance state comparable to George Orwell’s 1984.

“Bitcoin isn’t money. It’s past money, which is scary because it’s actually a new paradigm. We’ve never had access to perfect market information before, so the concept of money will have to evolve to fit reality, not stay the same because legacy deems it so.” — anonymous

The inception of the Cypherpunk era

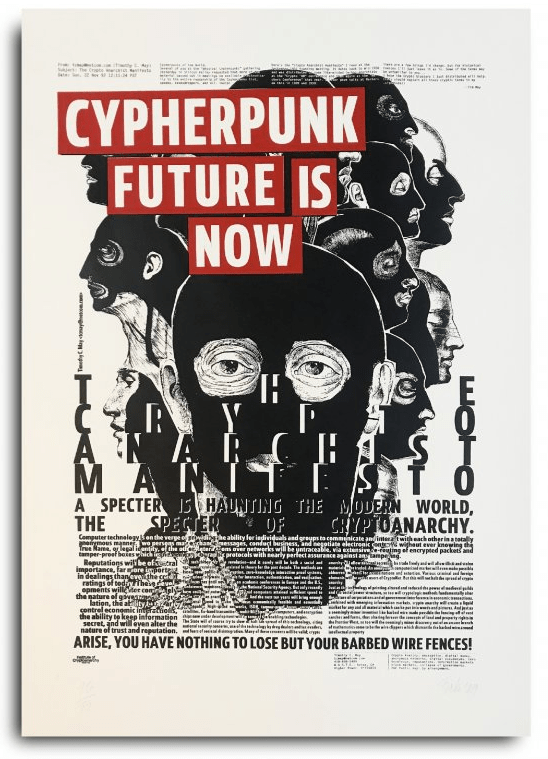

As a result, a number of computer programmers decided to rebel using their code as a weapon. Thus, in the latter parts of the 80s, the cypherpunk movement was conceived. Their main focus was the protection of people’s privacy in the digital world.

One of those original programmers was Eric Hughes, who collated their goals and intentions into a book called ‘A Cypherpunk’s Manifesto’. The cypherpunks wished to see both encrypted and safe communications in the digital world, including anonymous transactions. Unlike credit card transactions, where both the payer and receiver can be identified, cypherpunks were envisaging a digital currency with which people could both send and receive money without being tracked — not divergent to paying in cash at the local shops.

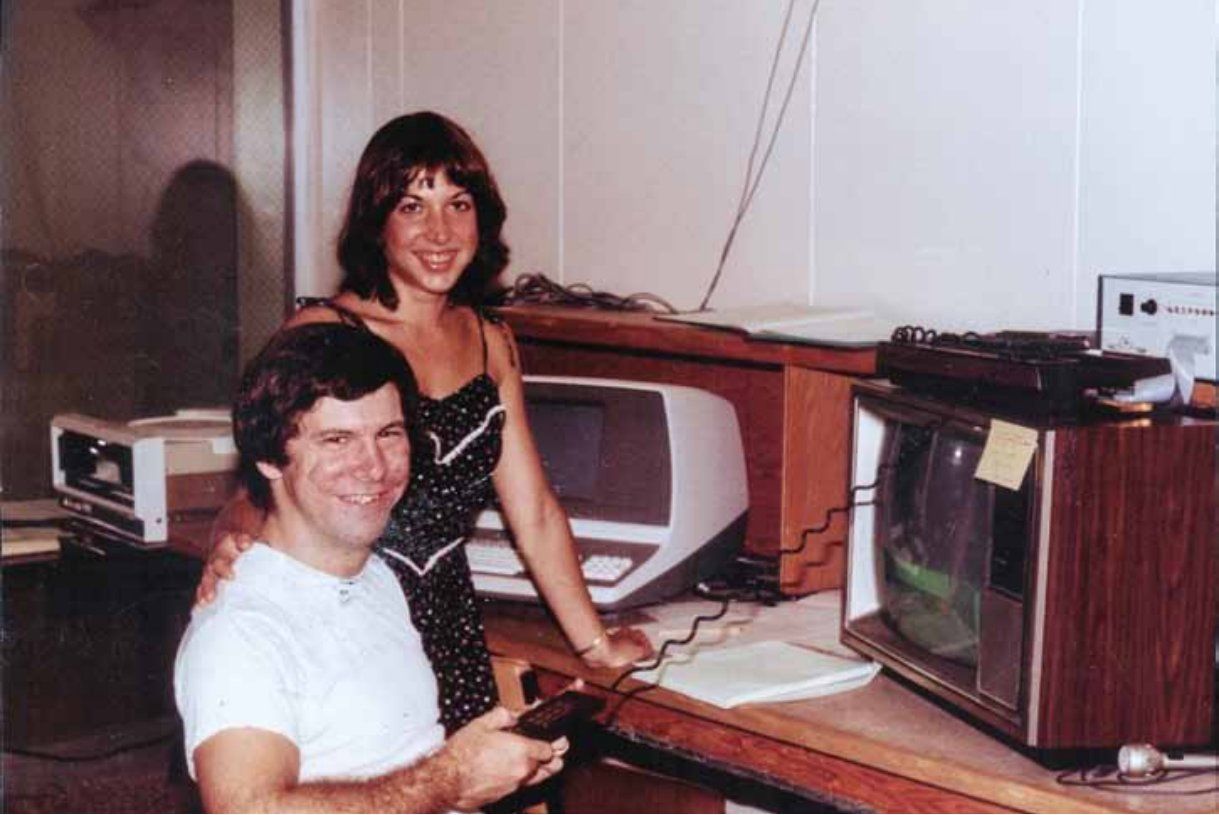

An American cryptographer, David Chaum, was at the forefront of this digital cash creation. In 1983 he published a scientific paper, Blind Signatures for Untraceable Payments, that outlined anonymous digital money. In 1989 he created ‘DigiCash’ which put the concept he outlined in his research into practice. DigiCash revolved around Blind Signature technology which warranted both the safety and privacy of transactions between individuals not dissimilar to the cryptocurrency concept we know today.

The concept of a blind signature, outlined in his paper, can be illustrated by an example taken from physical paper documents. The paper analog of a blind signature can be implemented with carbon paper lined envelopes. Writing a signature on the outside of such an envelope leaves a carbon copy of the signature on a slip of paper within the envelope.

At a similar time to the DigiCash concept being realised, leading Dutch supermarket Albert Heijn, pressured banking partners to come up with a way to allow shoppers to pay directly from their bank accounts in store, which acted as the foundation to the early point-of-sale systems; and consequently one of the earliest examples of electronic cash that we associate with present day digital currencies.

In 1997 they launched the Cypherpunks Distributed Remailer (CDR), which was the first step towards a private communication system, in essence, it acted as an anonymous, decentralised email system. Shortly after this was the inception of b-money, whose creation is credited to an individual with the online moniker ‘Wei Dai’.

How crypto was started by hackers and infiltrated by coders. Two are totally diff species. Most coders are submissive beurocats that have narrow spectrum. Nerds, naive like kids. They should not express their opinion except code they ordered to write. Hackers are warriors tho.

1814

German philosopher, Johann Gottlieb Fichte, became a founding figure of the philosophical movement known as German idealism. Of particular interest here, Fichte developed a theory about the ethics of currency. Recently, another philosopher evaluated the extent to which Bitcoin meets Fichte’s standards for a just and ethical currency. She concludes that “Bitcoin forsakes the general welfare and is, as such, unethical by Fichtean lights”

1837 to 1863

Is known as the free banking period in the history of American banking. After two attempts at establishing a central bank for the country (the First Bank of the United States and the Second Bank of the United States), the federalists lost the power struggle to the advocates of states’ rights, and all banks began to be chartered by the states. The result was a proliferation of banks. Each of these banks issued their own banknotes against their deposits of gold and silver. These notes did not trade one for one, and their value mostly depended on the size of the issuing bank. Issuing paper currency wasn’t just limited to banks; even drugstores and railroad and insurance companies sometimes issued their own notes. The notes were also of varying size and color, and forgers had a field day: approximately a third of all paper currency during this period was counterfeit. Benchmarks like the reserve ratio, the capital adequacy ratio, and interest rates were set by the states. About half of these banks failed, and their average lifespan was five years.

A total of 1,600 state-chartered private banks were issuing their own unique paper money in the U.S. in 1836. For example, it might take three $1 bills printed by a small-town bank to buy two $1 bills issued by a nearby large city bank. Situations like this meant that if someone traveled from a small town to a large city they might have to take 50% additional small-town cash because of the unfavorable exchange rate differences.

The National Banking Act of 1863 brought an end to the Free Banking Era of 1837-1862. Among other things, the National Banking Act created:

• A system of national banks that had higher reserve standards and more ethical business practices than the numerous state banks, many of which were chartered in Michigan.

• A uniform national currency, which required all national banks to accept the national currency at its full par (face) value.

• The Comptroller of the Currency. The money printed by the Comptroller of the Currency was manufactured using uniformly high quality standards that greatly reduced the widespread use of cheaply printed counterfeit money.

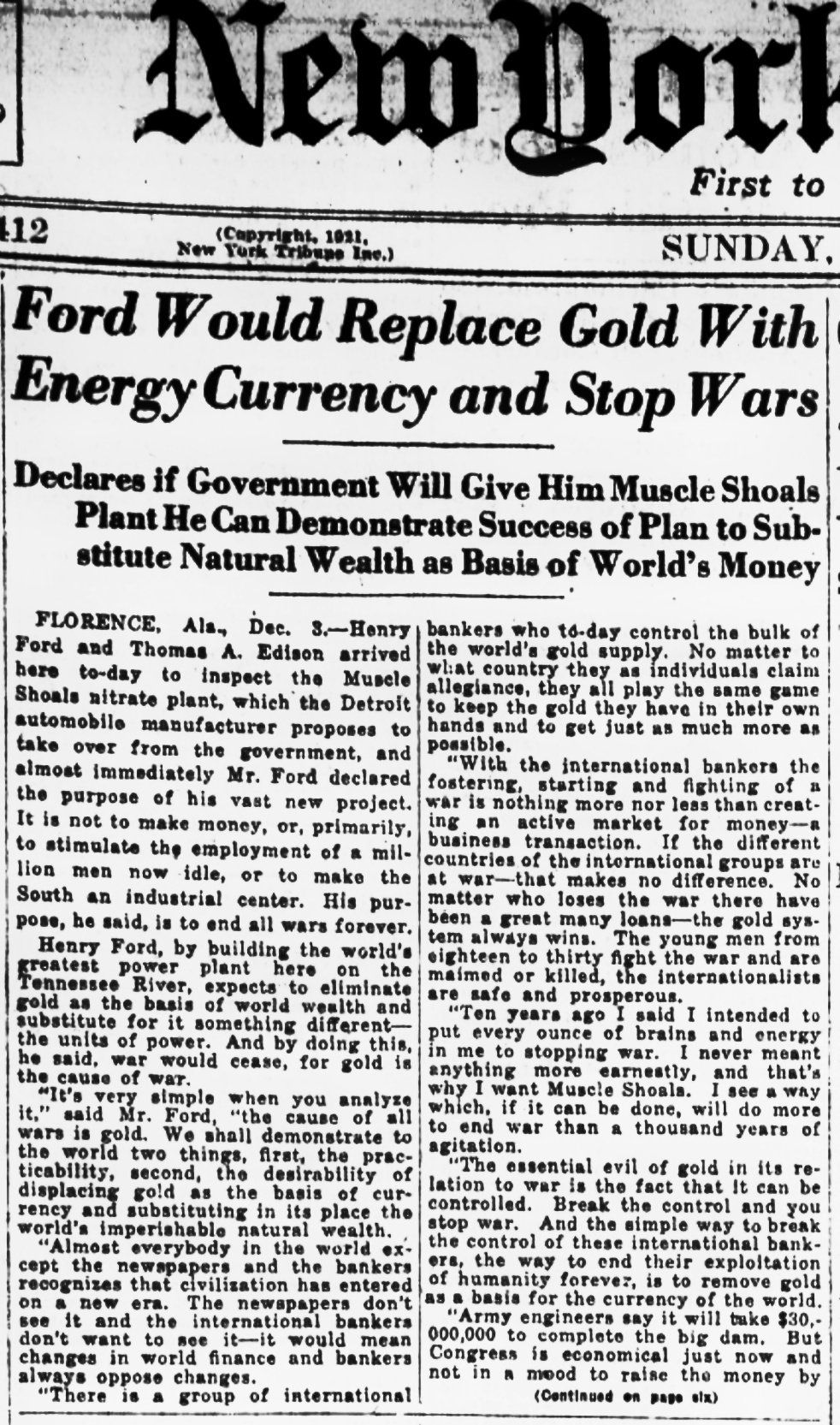

1921

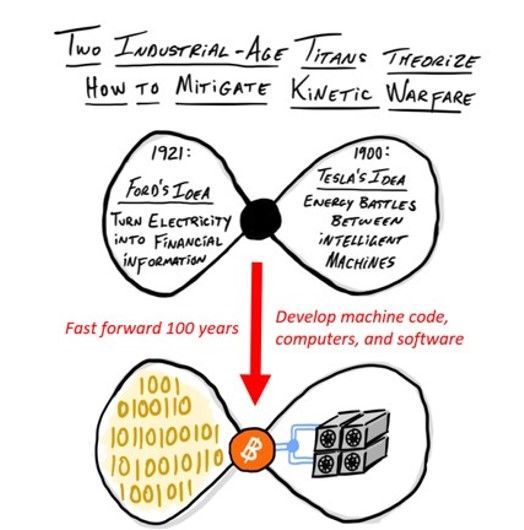

Henry Ford proposed a currency based on energy to replace the gold standard.

1940

1945

Born Martin Hellman

1954, August

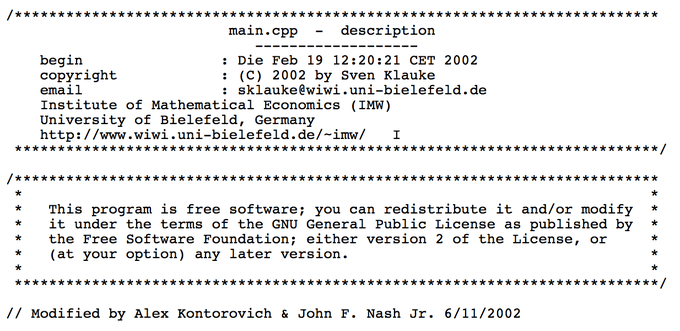

At 26 years of age, John Nash published a futuristic paper of decentralised computer processing units making for a parallel control machine, comprising a number of — at that time at least — subliminal ideas on a possible high speed digital system capable of directing simultaneous operations and interrelating them when appropriate.

Such a machine, Nash wrote, would not be intensive on the mathematical or programming labour required in solving a problem, having value for a wide range of applicability from high order and considerable interpretative capacity where the interpretation program would only need be represented once in handling several problems simultaneously.

Nash says this of the design:

“the mathematician should have to do little more than state the problem and general method of computation in almost ordinary mathematical style”

1967

Buckminster Fuller predicted Bitcoin and new wealth.

I’ll talk about something that would be one of the realizations by 2018 a realistic—scientific accounting system—of what is wealth. Wealth isn’t the gold of pirates — wealth is energy.

1970

Future Shock is a 1970 book by the futurists Alvin and Heidi Toffler, in which the authors define the term “future shock”, as a certain psychological state of individuals and entire societies. Their shortest definition for the term is a personal perception of “too much change in too short a period of time”.

The term F-you money has been a part of American culture since at least the 1970s, working its way over the decades from Hollywood to Wall Street to Silicon Valley as people in those industries amassed enormous wealth.

1971

Nixon Shock

1974

Friedrich Hayek won the Nobel Prize for Economics. Hayek was awarded the Nobel Prize for his pioneering work in the theory of money and economic fluctuations. Fast forward to today where many of his predictions are coming to life in the form of cryptocurrencies.

1976

Cipher Block Chaining (CBC) - https://en.wikipedia.org/wiki/Block_cipher_mode_of_operation#CBC

Diffie – Hellman key exchange

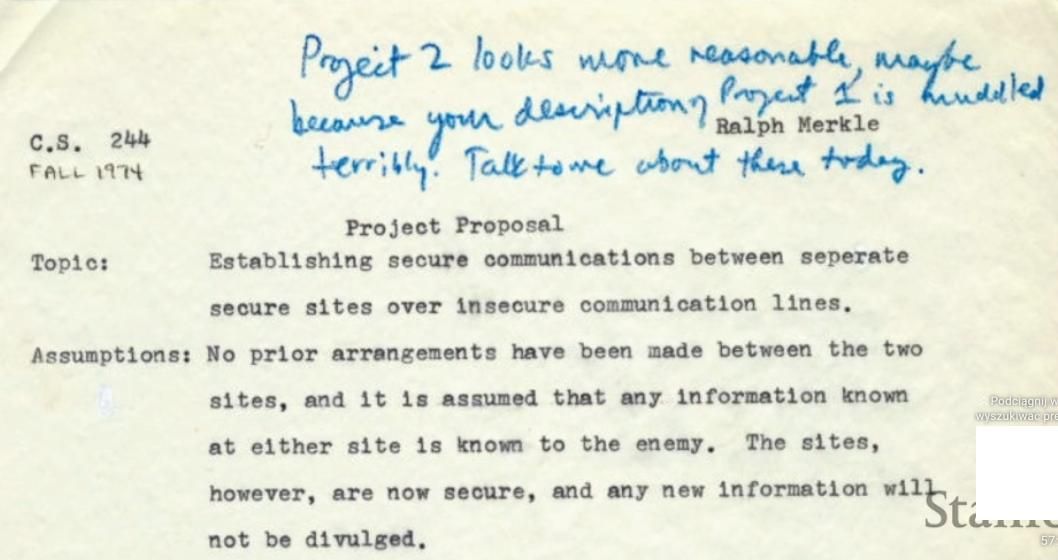

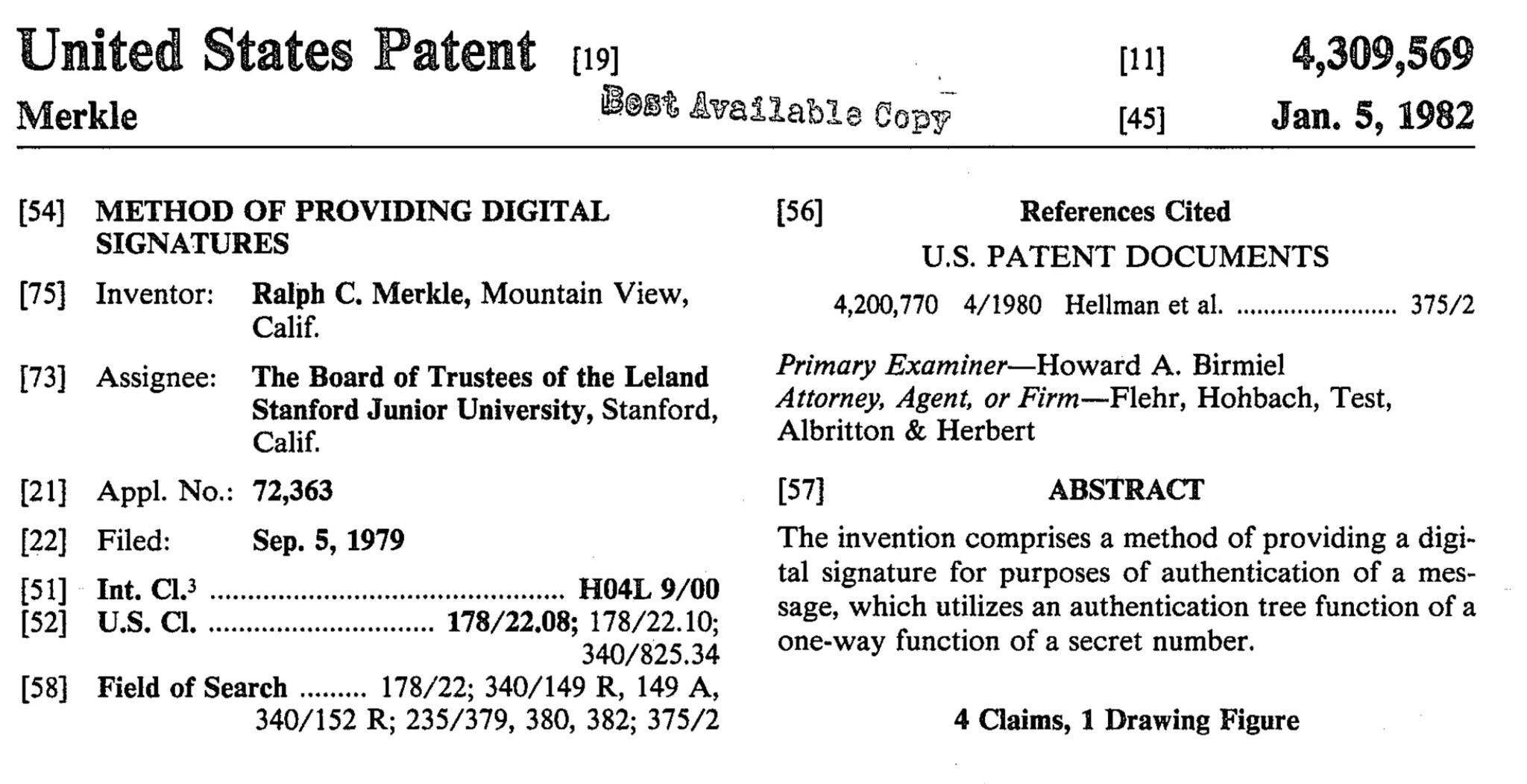

1978, April

Ralph Merkle published the article ‘Secure Communications Over Insecure Channels’ in which he “provides a logically new kind of protection against the passive eavesdropper.”

1980

Protocols for public key cryptosystems, R.C. Merkle

1981, November

„Hash chain”: L. Lamport, “Password Authentication with Insecure Communication”, Communications of the ACM 24.11 https://en.wikipedia.org/wiki/Hash_chain

1982

A Merkle tree is a tree that defines each non-leaf node with a value or a label and contains a hash of its children. This builds hash trees and is used to provide a verification of large-scale data structures.

In five short pages, in Sept 1979, he laid out the method that has become what we would know as blockchain.

The patent was assigned to Stanford, and where it outlined a way to validate data through a tree of hashes, and where the top-level hash could be used to validate all the data within a block.

1983

David Chaum, Blind Signatures for Untraceable Payments, proposes an early form of digital value transfer The late 1980s — likeminded individuals began to pool ideas founding the Cypherpunk movement.

Ecash was conceived by David Chaum as an anonymous cryptographic electronic money or electronic cash system in 1983. It was realized through his corporation Digicash and used as micropayment system at one US bank from 1995 to 1998.

1984

The kind of money we are having is getting so much worse that people will ultimately reject it for a better one. - Hayek

1985

Zero-knowledge proofs first appeared in a 1985 paper, “The knowledge complexity of interactive proof systems” which provides a definition of zero-knowledge proofs widely used today:

A zero-knowledge protocol is a method by which one party (the prover) can prove to another party (the verifier) that something is true, without revealing any information apart from the fact that this specific statement is true.

1987

1989

DigiCash launch, the late 1980s — likeminded individuals began to pool ideas founding the Cypherpunk movement

1990

Steve Jobs talking about DAOs

1991

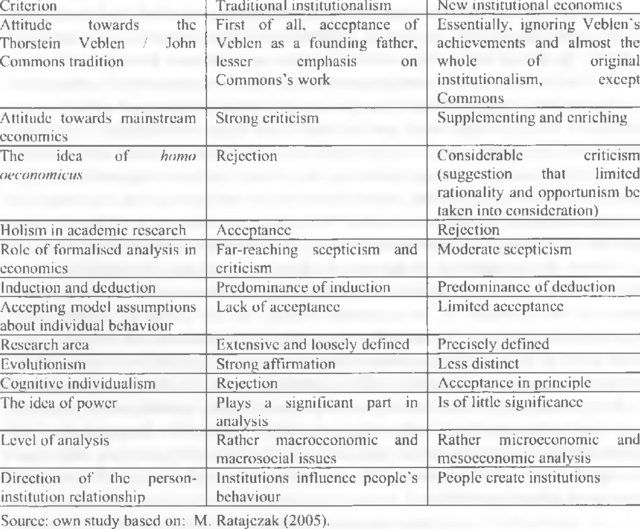

“New institutional economics” (NIE) was introduced by Oliver Williamson.

Douglas North published a paper, entitled ‘Institutions,’ in the Journal of Economic Perspectives. This paper summarized much of his earlier research relating to economic and institutional change. North defines institutions as “humanly devised constraints that structure political, economic and social interactions”. Constraints, as North describes, are devised as formal rules (constitutions, laws, property rights) and informal restraints (sanctions, taboos, customs, traditions, codes of conduct), which usually contribute to the perpetuation of order and safety within a market or society. The degree to which they are effective is subject to varying circumstances, such as a government’s limited coercive force, a lack of organized state, or the presence of strong religious precept.

Section 2 of North’s 1991 paper describes the economic development of societies as occurring in stages:

North begins with local exchange within the village. In this setting, specialization “is rudimentary and self-sufficiency characterizes most individual households”, with small-scale village trade existing within dense social networks of informal constraints that facilitate local exchange, and a relatively low transaction cost. However, this confined market reduces the potential of specialization and increases production costs. In this close-knit network “people have an intimate understanding of each other, and the threat of violence is a continuous force for preserving order …”

Two research scientists, Stuart Haber and W. Scott Stornetta, identified a problem: How can it be ensured that digital documents are authentic and changes to them are tracked in an immutable time-stamped manner? In “How to Time-Stamp a Digital Document”, they worked on the concept of append-only, cryptographically secured logs. With their work, the foundations of what much later becomes blockchain technology were laid. Haber and Stornetta’s work was later followed and elaborated on by Ross J. Anderson in 1996 when he described the creation of The Eternity Service, a storage medium resistant to DoS attacks using redundancy and scattering techniques, as well as anonymity mechanisms.

All dystopian societies are surveillance societies. When you lose privacy, you lose everything. - Phil Zimmermann

In 1991, Phil released PGP, the world’s first widely available program implementing public-key cryptography.

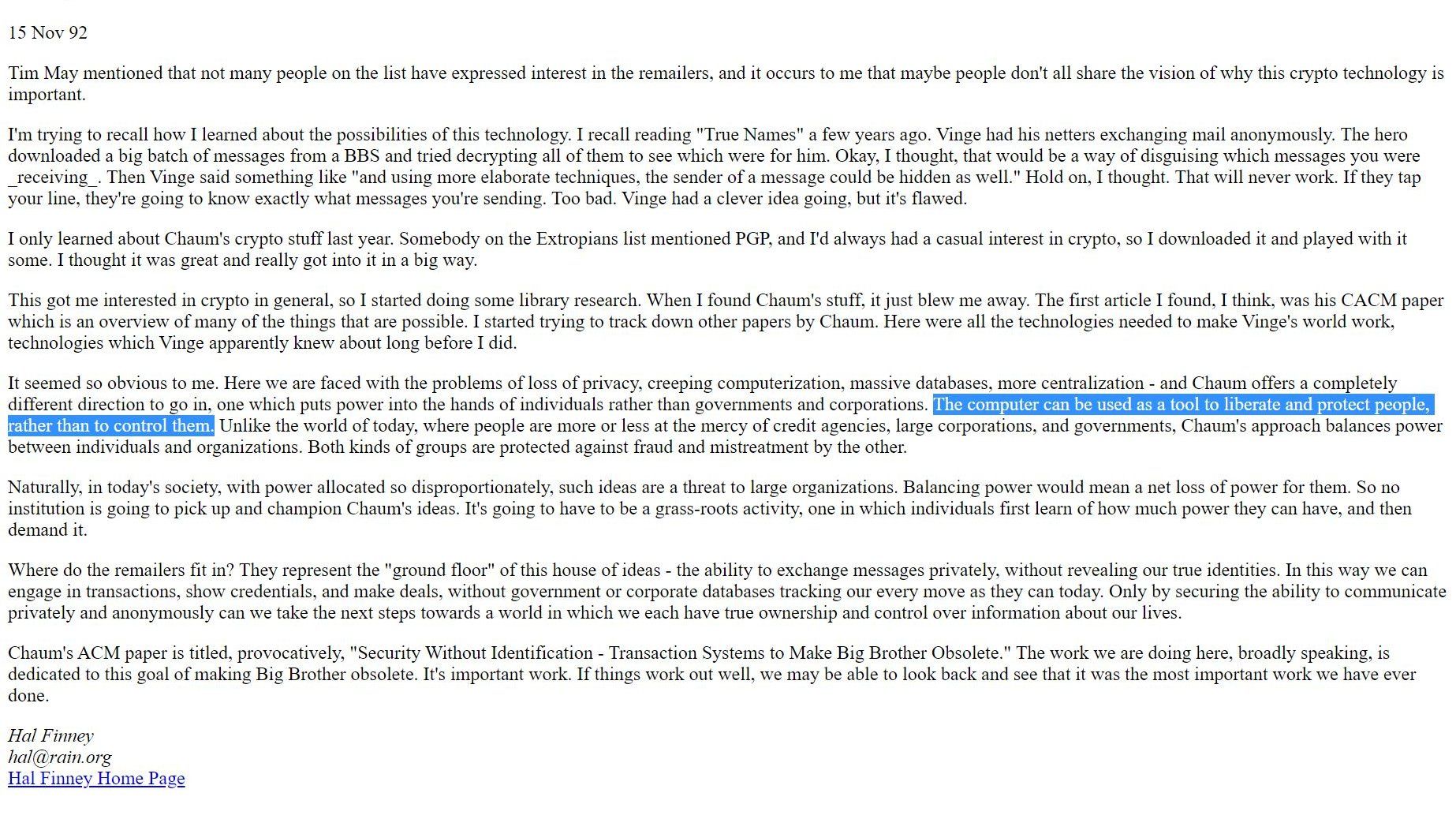

1992

Creation of ‘A Cypherpunk Manifesto’ by Eric Hughes.

Cypherpunks write code. - Eric Hughes

“A specter is haunting the modern world, the specter of crypto anarchy.”

The Crypto Anarchist Manifesto - Timothy C. May - Sun, 22 Nov 92 12:11:24 PST

One of the founder of Cypherpunks mailing list was John Gilmore.

1993

Eric Hughes - Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn’t want the whole world to know, but a secret matter is something one doesn’t want anybody to know. Privacy is the power to selectively reveal oneself to the world.

Mondex

Bill Gates was proposing to cooperate with David’s Chaum DigiCash to implement the e-money in Windows 95.

David Chaum answered:

No, thanks Bill.

…

The concept of proof-of-work (PoW) system invented by Cynthia Dwork and Moni Naor and presented in a journal article. More specifically, they explained the idea in a paper published in 1993 called “Pricing via Processing or Combatting Junk Mail.”. The term “proof of work” was first coined and formalized in a 1999 paper by Markus Jakobsson and Ari Juels.

Alternative namings for Proof of Work:

- stamp by back

- hash cash by back

- break pudding protocol

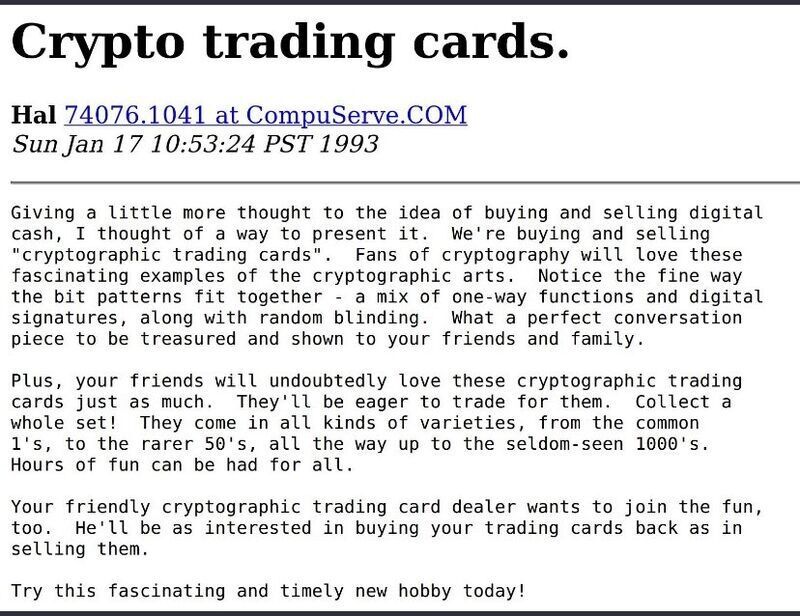

Hal Finney describing ‘crypto trading cards’ aka NFTs in 1993

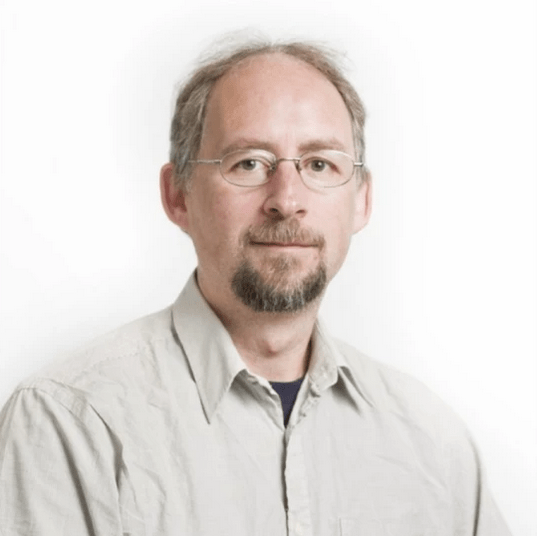

Harold Finney (May 4, 1956 – August 28, 2014) was a developer for PGP Corporation, and was the second developer hired after Phil Zimmermann. In his early career, he was credited as lead developer on several console games.

He also was an early bitcoin contributor and received the first bitcoin transaction from bitcoin’s creator Satoshi Nakamoto.

1994

Computer scientist Nick Szabo first described the concept of smart contracts. It is important to recognize that Szabo’s intent was to minimize the need for trusted intermediaries. In 1998 he proposed BitGold, a conceptual predecessor to Bitcoin as he argued for a decentralised digital currency. In both, PoW is used as a consensus algorithm to solve cryptographic puzzles in a P2P network with Byzantine Fault Tolerance. The solutions are also linked together by a “hash chain” (See: Moskoy, Phillip (2018): What Is Bit Gold? The Brainchild of Blockchain Pioneer Nick Szabo). Although BitGold was never implemented, many perceive it as being the direct ancestor to BitCoin.

October 11, 1994

The Royal Swedish Academy of Sciences has decided to award the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel, 1994, jointly to

- Professor John C. Harsanyi, University of California, Berkeley, CA, USA,

- Dr. John F. Nash, Princeton University, Princeton, NJ, USA,

- Professor Dr. Reinhard Selten, Rheinische Friedrich-Wilhelms-Universität, Bonn, Germany,

The special commodity or medium that we call money has a long and interesting history. And since we are so dependent on our use of it and so much controlled and motivated by the wish to have mor eof it or not to lose what we have we may become irrational in thinking about it and fail to be able to reason about it like about a technology, such as radio, to be used more or less efficiently.

Lecture by John F. Nash Jr. Ideal Money and Asymptotically Ideal Money

CyberCash

1995

A Lifetime Dedicated To Citizen’s Rights To Privacy: Daniel J Bernstein Outlining Curve 25519 and Edwards 25519

Daniel J Bernstein (djb) was born in 1971. He is a USA/German citizen and a Personal Professor at Eindhoven University of Technology and a Research Professor at the University of Illinois at Chicago.

At the tender age of 24 — in 1995 — he, along with the Electronic Frontier Foundation — brought a case against the US Government related to the protection of free speech (Bernstein v. United States).

It resulted in a ruling that software should be included in the First Amendment. A core contribution is that it has reduced government regulations around cryptography. It was a sign of the greatness that was to come from the amazing mind of Daniel. His viewpoint on reducing the strength of cryptography at the time defined:

“There are, fortunately, not many terrorists in the world. But there are many criminals exploiting Internet vulnerabilities for economic gain. They infiltrate computers and steal whatever secrets they can find, from individual credit-card numbers to corporate business plans. There are also quite a few vandals causing trouble just for fun.”

Since then, few others have done so much for the cause of privacy, including creating the Sala20 stream cipher in 2005, and then with ChaCha20 [link] and Poly1305 in 2008. Many connections in TLS now use ChaCha20, rather than AES, as it is faster — over three times after than AES — and has a lower computing requirement. His love of using dance names also comes to the fore with Rumba.

It is not just in symmetric key encryption that he has contributed to, he has made significant contributions to public key encryption. In 2005, he defined the Curve 25519 elliptic curve, and which is now a fairly standard way of defining elliptic curves. For signatures, he then defined Ed25519, and the resultant version of a new EdDSA signature (and which is now included in OpenSSH). The Tor protocol, for example, uses Curve 25519 for its key exchange for each of the nodes involved in a secure route. In 2015, Daniel defined the methods that the NSA may have used to compromise the NIST-defined elliptic curves

One of the coolest things, is that Daniel runs a domain name https://cr.yp.to/.

1996

https://en.wikipedia.org/wiki/A_Declaration_of_the_Independence_of_Cyberspace

1997

Jim Choate and Igor Chudov set up the Cypherpunks Distributed Remailer

The launch of b-money an ‘anonymous, distributed electronic cash system’; https://en.wikipedia.org/wiki/Cypherpunk#History

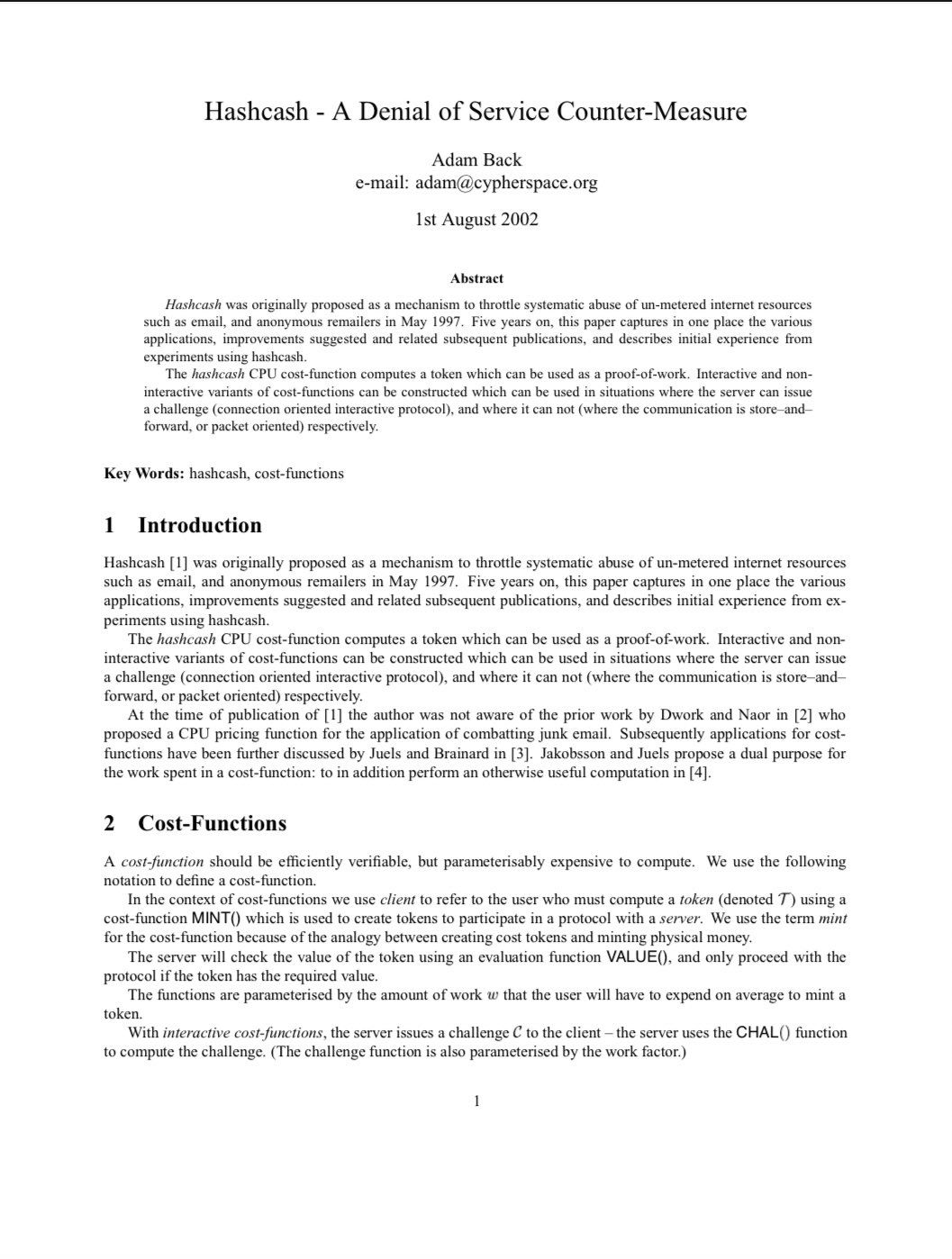

Initial proposition of Hashcash by Adam Back; The launch of b-money an ‘anonymous, distributed electronic cash system’. An essential component for Bitcoin was created by Adam Back: the Proof-of-Work algorithm.

Adam Back, was a subscriber to the Cryptography Mailing List, and it was this channel that he used to publicize his invention in March 1997 by sending an email. At the time, Back was taking a postdoc at the University of Exeter in the UK and was 26 years old. Your idea can be compared to buying a stamp to add to an email, using a “cryptographic trick”.

Subscribers to the List were called Cypherpunks, and used the science of cryptography to carry forward the main values they defended in this forum: privacy, freedom of expression and libertarianism. Adam Back has become one of the most active participants on the List, sending dozens of emails a month. He was involved in technical discussions about file encryption systems or electronic money, such as the one developed by Dr. David Chaum.

Professor Adam Back and his Hashcash, are one of the references named by Satoshi Nakamoto, in the Bitcoin paper. It was in this way that he recognized the importance it had in the creation and development of Bitcoin. Without the Proof-of-Work algorithm, a decentralized electronic money system would not be possible.

Currently, Dr. Adam Back is the CEO of Blockstream, a leading crypto company that is dedicated to building products and services to take blockchain technology further.

B-money: the Bitcoin predecessor

B-money operates similarly to how bitcoin works today, all users of the currency held a copy of the transaction ledger so that all payments were posted for everyone to see and potentially approve or dispute. The prominent difference between b-money and bitcoin is that in 1997, there was no decentralised way to maintain the accounts.

DigiCash, created by David Chaum, was launched prior to e-commerce taking shape on the internet and ended up filing for bankruptcy in 1998, as online shoppers opted to use the familiarity of credit cards over anonymity for online purchasing. That being said, some of the concepts, formulas and encryption methods outlined by David Chaum, acted as a foundation for digital currencies developed in the future.

There have been other attempts to create cryptocurrencies since DigiCash and b-money, but these attempts were extinguished at the time of the dot-com bubble bursting at the turn of the century.

Prior to bitcoin, the most successful digital currency is arguably Hashcash. This currency was created as prevention to email spam and DDoS attacks. Hashcash utilised the proof-of-work algorithm that both aided the generation and distribution of new coins, a technique used in many of the cryptocurrencies we know today. Hashcash faced increasing processing power demand, which it was unable to supply, and consequently became less and less effective before the platform was eventually closed down.

With which nearly a decade of silence ensued, until 2008, when bitcoin emerged, becoming the world’s first decentralised digital currency.

“We need banking. We don’t need banks anymore.” (Bill Gates, 1997)

1998

Digicash begins bankruptcy proceedings after being unable to grow its userbase and Wei Dai proposed B-money to allow for an “anonymous, distributed electronic cash system”. Bruce Schneier and John Kelsey proposed a computationally cheap way to safeguard sensitive information and allow for computer forensics with secure audit logs by using hashing, authentication keys, and encryption keys (See: Schneier, B. & Kelsey, J. (1998): Secure Audit Logs to Support Computer Forensics).

The smallest unit of Ether is wei, named after the cypherpunk Wei Dai.

1 $ETH is equal to 1,000,000,000,000,000,000 wei. That’s one quintillion, or 10¹⁸ (eighteen zeros).

Another unit, Gwei, equals 1,000,000,000 wei.

Often Gwei is used for gas prices, and wei is used in code.

Nick Szabo proposed Bit Gold. Where unforgettable proof of work chains would share properties of gold: scarce, valuable and trust minimised but with the benefit of being easily transactable. Bit gold was never implemented, but has been called “a direct precursor to the Bitcoin architecture.”

“Money is an artifact of civilization. So also is the standard kilogram which is a mass of platinum-iridium alloy that is kept in a special international institution located near Paris.” - John F Nash Jr., 1998

Hal Finney discusses Zero-Knowledge Proofs at Crypto ‘98 in Santa Barbara!

B-money 2.0

In his proposal, Dai also described how to create money, transfer money and resolve contractual conflicts. However, he believed that his protocol was not possible to become a practical application, as it did not prevent the problem of double spending, and therefore presented a second version of his b-money protocol.

In this second version, there would be servers that were responsible for keeping the record books up to date. Users would have to check with the servers if the transactions were legitimate, if they were not able to reject them.

Anyone could create a server. It would be enough to make a deposit of a certain amount of money that would be used in a system of penalties or rewards. This system is also similar to what we now know as Proof-of-Stake, and which is used in several cryptography.

September 1998

The high-tech company DigiCash finally went bankrupt. The office in Palo Alto, California remained open for a while but it was merely a stay of execution. Two months ago the company filed for Chapter 11.

Nobody realizes, but with the “pending failure” of DigiCash, a bit of Dutch Glory died. The company made a brilliant product. Even Silicon Valley was jealous of the avant-garde technology invented in the Amsterdam Science Park. Internet “guru” Nicholas Negroponte went so far as to call the electronic payment system, ecash1, “the most exciting product I have seen in the past 20 years.” The rise and fall of DigiCash: a story of paranoia, idealism, amateurism and greed.

1999

Milton Friedman said:

The internet is going to be one of the major forces for reducing the role of government. The one thing that is missing is a reliable e-cash, a method by which on the internet you can transfer funds from A to B anonymously.

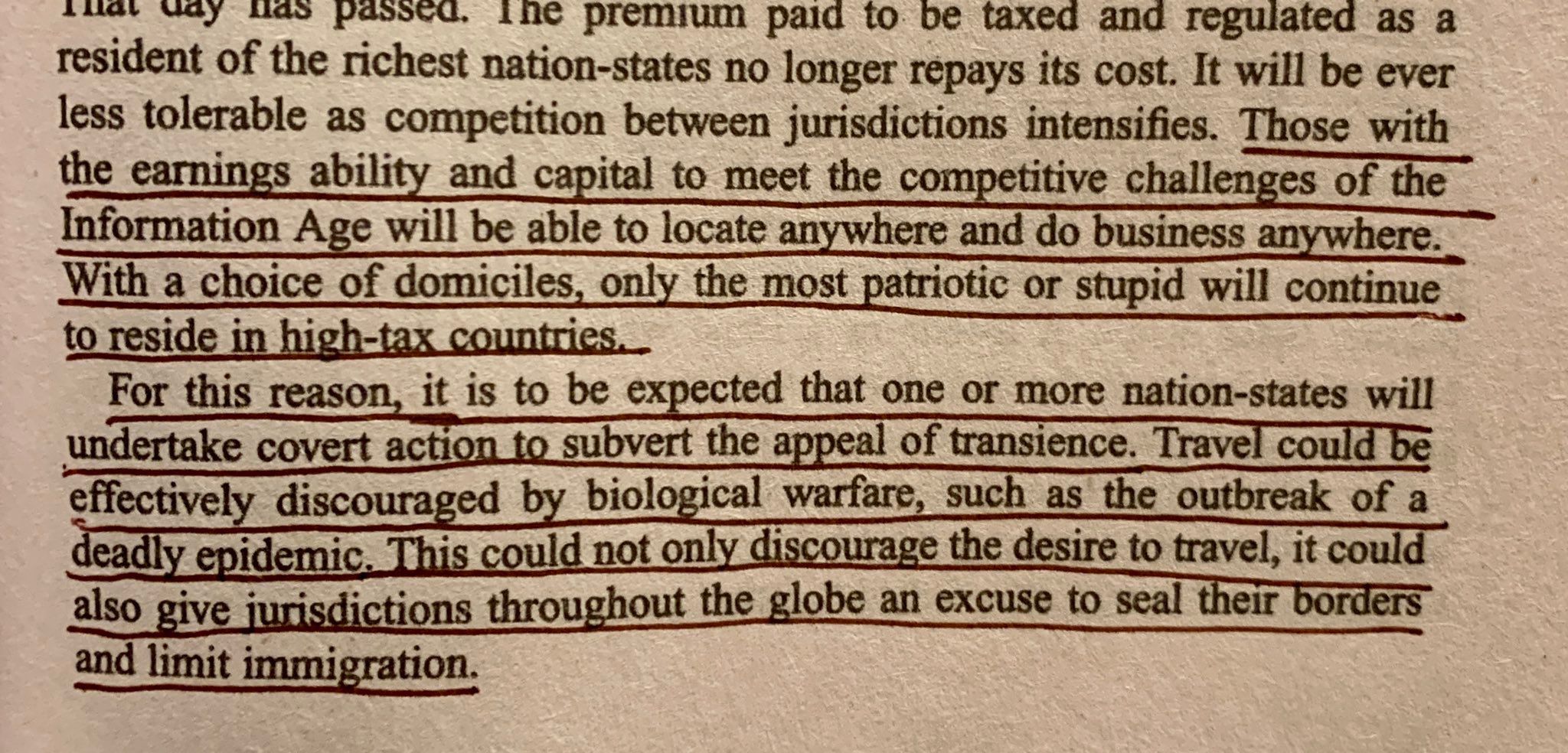

The Sovereign Individual: Mastering the Transition to the Information Age

Peter Thiel talks about a currency that cannot be stopped

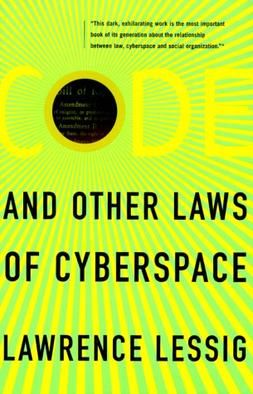

Lawrence Lessig takes seriously the proposition that, in cyberspace, code is the law, and he traces out the consequences in a lucid and insightful way. If you want to know what daily life will be like in the computer-mediated twenty-first century, this is essential reading.

2002

Adam Black more formerly outlines the Hashcash concept in his paper ‘Hashcash — A Denial of Service Counter-Measure’

As the Ideal Money evolved, so comes Nash’s introduction of an “Asymptotically Ideal Money” and how the ICPI might be useful going beyond the territory of a singular state: Nash remarks the “asymptotic” behavior of a value under comparison can be different from an earlier apparent pattern, differentiating also between the applicability of a world empire context in the Ideal Money and the Asymptotically Ideal Money. While having reasonable likely expectation of the Asymptotically Ideal Money, Nash expresses doubts in 2002 as to the “Ideal Money” being accepted into the world empire:

“One cannot logically feel confident of the adoption internationally of an ideal system of currency or currencies in an achievement analogous to the achievement of the metric system or of “the euro”.

2003

I2P

2004

Hal Finney built upon the idea of Hashcash and created Reusable Proofs of Work.

“Linked Data is about using the Web to connect related data that wasn’t previously linked, or using the Web to lower the barriers to linking data currently linked using other methods. More specifically, Wikipedia defines Linked Data as “a term used to describe a recommended best practice for exposing, sharing, and connecting pieces of data, information, and knowledge on the Semantic Web using URIs and RDF.” Linked Data, a term coined by Sir Tim Berners-Lee, is a way of publishing data online so it can be easily interlinked and managed using semantic queries. This helps the exposure and interlinking of datasets so that data can be exchanged, reused and integrated.

BLS Signatures - introduced by Dan Boneh and Benn Lynn and Hovav Shacham. Are defined over pairing-friendly elliptic curves (Bitcoin’s secp256k1 is not one of)

November 1, 2008

Message on email list. http://satoshinakamoto.me/2008/11/01/bitcoin-p2p-e-cash-paper/

November 9, 2008

Bitcoin project registered on Sourceforge.

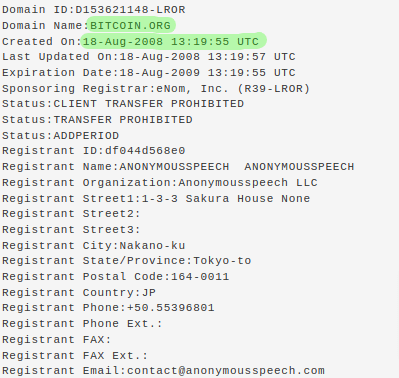

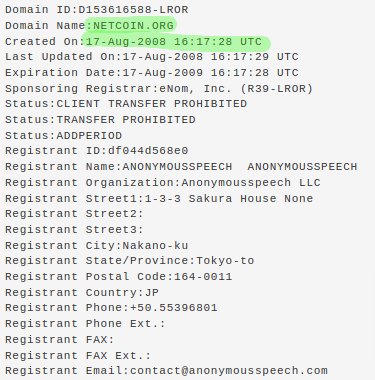

August 17 and 18, 2008

The Bitcoin domain was registered.

October 31, 2008

The ‘Bitcoin: A Peer-to-Peer Electronic Cash System’ paper was distributed to a cryptography mailing list by Satoshi Nakamoto

Satoshi Nakamoto and the creation of Bitcoin

To this day, we do not know who is behind the white paper or the first implementation of the client. Satoshi Nakamoto is the pseudonym used by the person or group that published the white paper. As you might have seen in the news, the identity of Nakomoto has sparked plenty of conspiracy theories as several individuals have claimed to be the creator of Bitcoin. But to this date, none of the claims have been verified.

What is certain is that the community initially working on the network and the client can be characterised as generally pro-capitalist, anti-regulation and monopoly, as well as pro-free-trade. Many of those developing and driving the technology have also heralded its potential to reduce corruption and perceived human failures by pushing processes out of human reach.

All this may not seem important but it is. Blockchain technology was built with disruption in mind. It was envisaged as the antithesis of the central control of banks, governments, and incumbent holders of monopolies. This has an influence on the direction of the technology and remains a strong influence on its development.

Given its anti-establishment roots, blockchain technology has been seized upon by other groups interested in circumventing government, law enforcement, or regulatory control, both on the radical right and left fringes, as well as among activists persecuted by their governments.

Bitcoin’s creation is attributed to the alias Satoshi Nakamoto, the true identity of this individual (or individuals) remains a mystery even to this day. Nakamoto was however very clear with his intentions, he wanted the concept of a traditional bank, a centralised financial institution, to become redundant. This is why bitcoin does not operate on any centralised registry and why all transactions are made directly between users.

After the 2008 financial crisis, there was significant disillusionment with the current centralised banking system. As frustration grew, individuals sought alternatives, which is what bitcoin was created to be. As a result, bitcoin began to gain traction and has grown to become what it is today.

Whilst bitcoin has a number of characteristics like traditional money (portability, scarcity, durability, fungibility, divisibility and recognisability) it is orientated around mathematical properties rather than trust in physical backing (like silver and gold) or central authorities (like fiat currencies). With all these attributes, all that is required for a particular form of money to hold value is adoption and trust.

In the case of bitcoin, this metric can be measured in the growing number of users, merchants and startups utilising bitcoin. As with all currency, bitcoin’s value derives from people’s willingness to accept them as payment.

John F Nash:

“people should be able, in principle, to decide on the form of a money…they be served by…most typically the people would expect to be served by their elected representatives and not to make most of the relevant decisions in a direct fashion” Then we consider, as a game played repeatedly, a transform of the original game which has the rule that coalitions can only be formed by means of elective actions of “acceptance” by which one player (or one agent) accepts the agency function of another player (or agent).

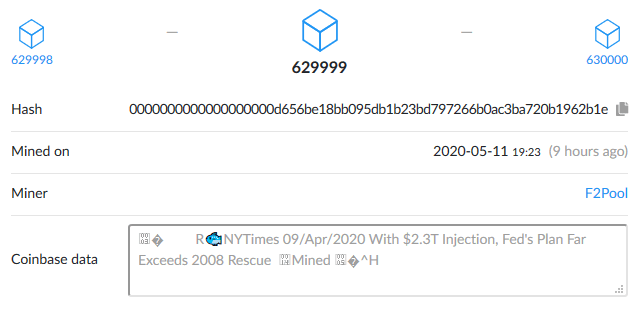

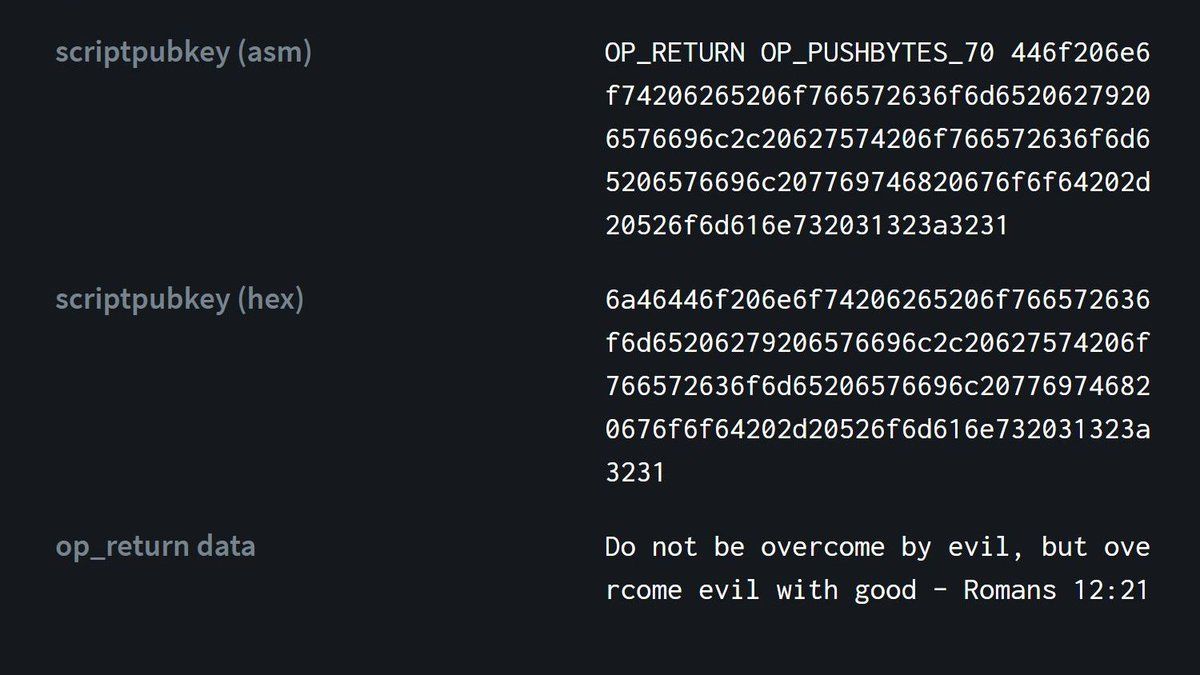

January 3, 2009

— The Bitcoin genesis block was mined — embedded in this block was the text ‘The Times 03/Jan/2009 Chancellor on brink of second bailout for banks’

“Genesis” could be a biblical reference for two reasons. First, the Genesis block paved the way for Bitcoin as we know it today. It was a testament to the refined genius of its creator. Secondly, the next block was mined six days later - unlike today, where a new block is mined every 10 minutes or so. It’s like how God rested for 6 days after creating the universe.

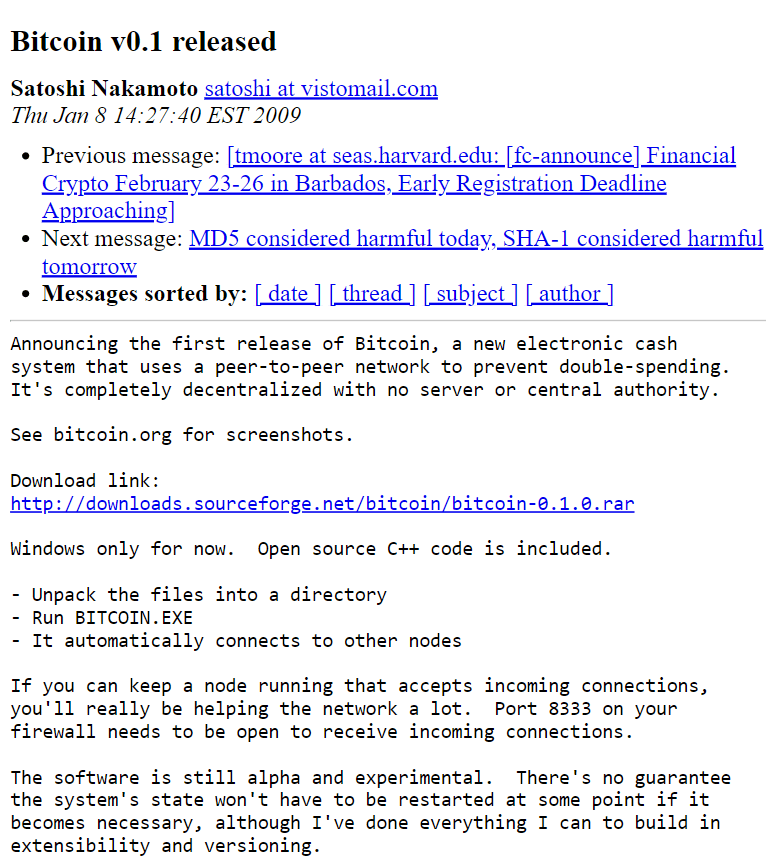

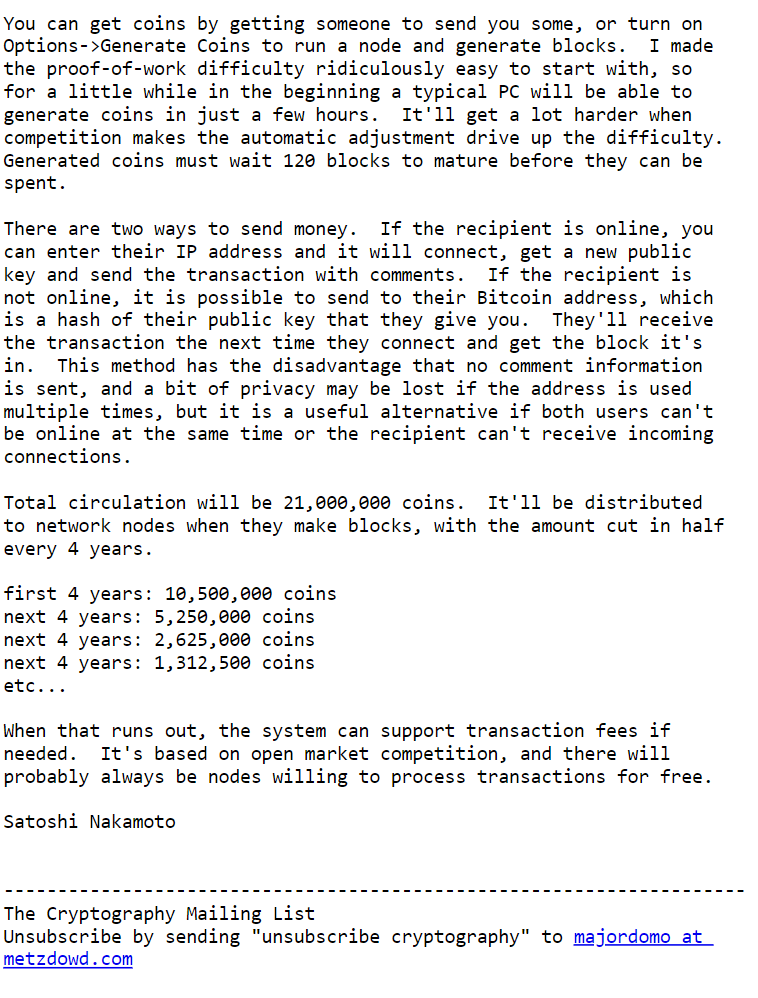

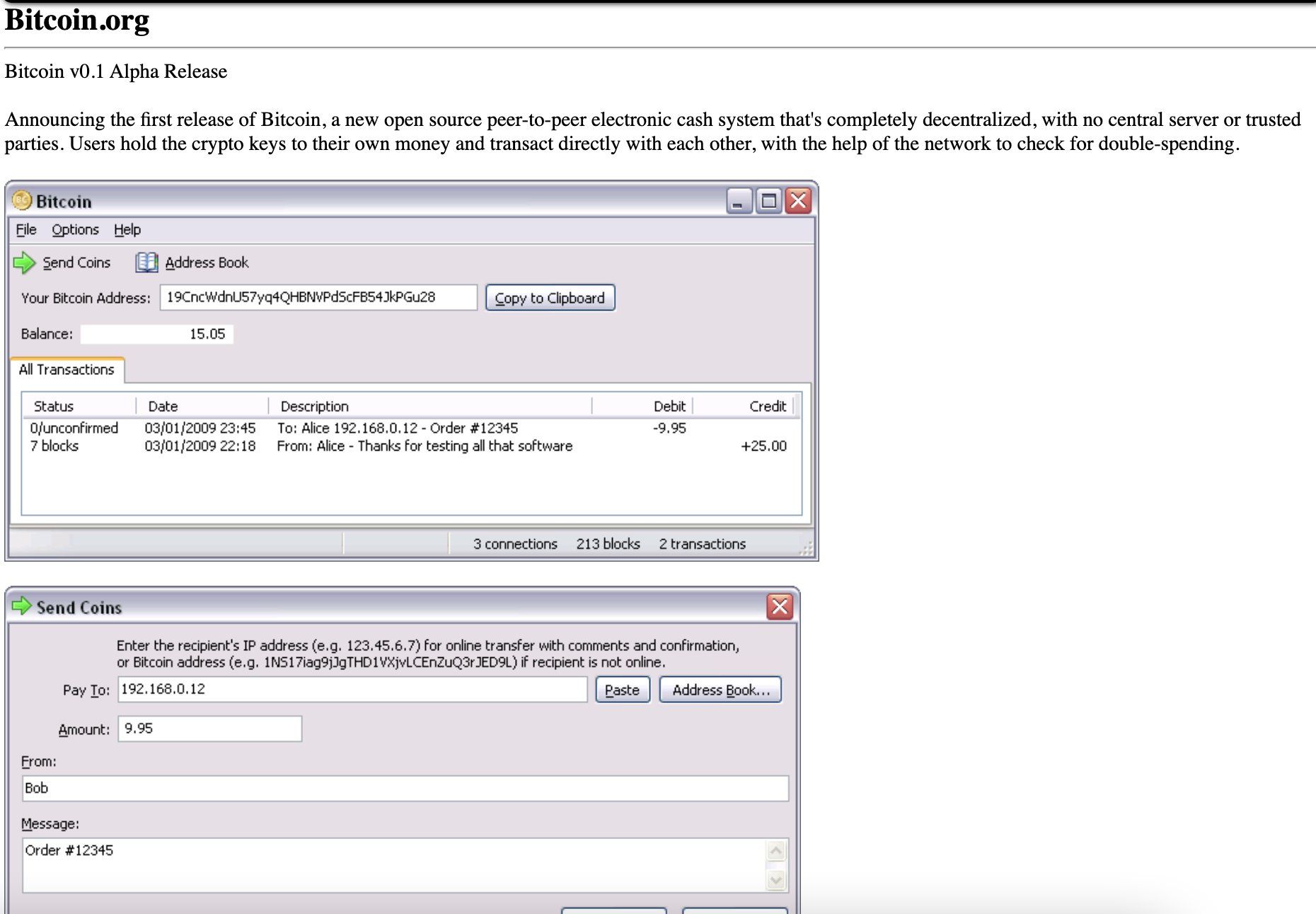

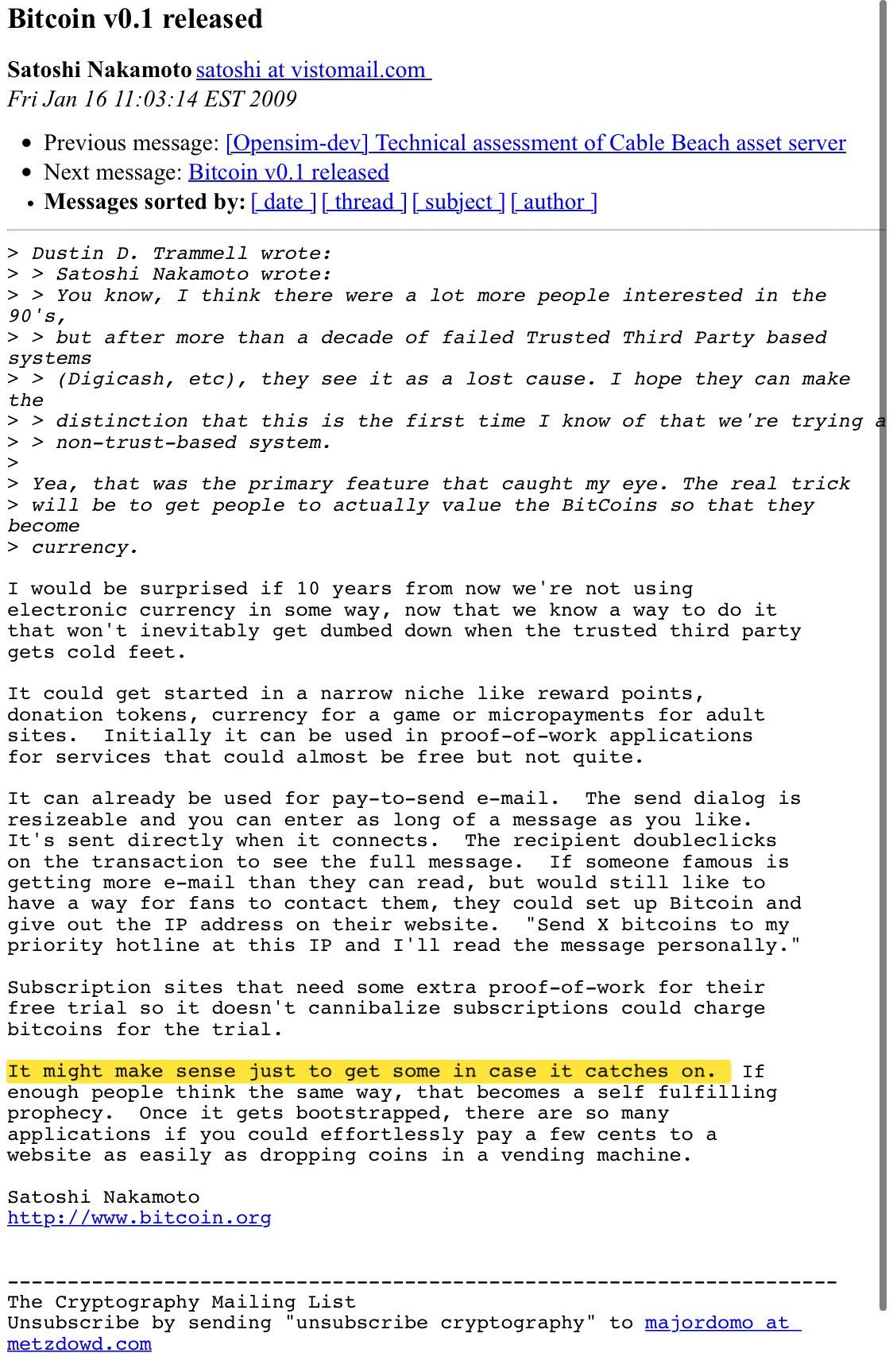

January 8, 2009

Satoshi Nakamoto released the first code of Bitcoin v0.1.

January 12, 2009

The “first transaction” was made when Satoshi sent Bitcoin to Finney.

January 16, 2009

February 11, 2009

May 22, 2010

Laszlo Hanyecz agreed to pay 10,000 Bitcoin for two delivered Papa John’s pizzas, one of the first documented transactions.

August, 2010

November 10, 2010

Bitcoin and Wikileaks When the United States blocked Wikileaks access to its funds, a bitcoin user suggested that Wikileaks use bitcoin. Other users joined the conversation, some recommending not doing so due to the negative attention that could be given to the cryptocurrency when relating it to the organization.

“Shitcoin” was born.

December 12, 2010

Satoshi’s last post Nakamoto posted his latest post on the Bitcoin Forum. In a few months, he stopped contributing, and Andressen took the lead. Nakamoto’s identity remained a mystery.

Bitcoin’s roller coaster and first hack: bitcoin equaled the dollar

Little more to say than BOOM! At this moment, the attention of the media began to shoot up.

2011

Utilising Bitcoin’s open-source code, other cryptocurrencies began to emerge

June 13, 2011

First attack A user denounced the first hack in the forum, a theft of 25,000 BTC. At the time of the robbery, the value was $ 500,000. The community was starting to take the security of their wallets more seriously.

April, 2011

Bitcoin is designed to bring us back to a decentralized currency of the people,” and “this is like better gold than gold” - Gavin Andresen

August, 2011

September 27, 2012

Bitcoin Foundation The Bitcoin Foundation was created, becoming the semi-official home of the cryptocurrency.

November 18, 2013

Mining 1 whole Bitcoin a day from home with a gaming computer in 2013 👀

---Bitcoin reached the ears of the Senate The Senate Security and Government Affairs Committee held the first debate on Bitcoin. Two days later, the same thing happened in the Senate Banking Committee, and the regulators agreed to do nothing to prevent the development of the currency.

2013

Dr. Richard Stallman said:

American Capitalism has turned into Plutocracy

2014

Ethereum has a much faster block time, i.e. the time it takes to generate a new block, than Bitcoin (currently around 15s), made practical thanks to its implementation of the GHOST protocol (https://www.cs.huji.ac.il/%7Eyoni_sompo/pubs/15/inclusive_full.pdf). Ethereum implements a variation of Bitcoin’s proof-of-work consensus algorithm called Ethash, which is intended to be ASIC-resistant and GPU friendly(https://github.com/ethereum/wiki/wiki/Ethash-Design-Rationale). Core developers of the Ethereum project are planning to switch to the proof-of-stake consensus algorithm in the future.

Ethereum Vision was laid out in the conference which was held in Miami on Jan 2014. Below picture was from the very first Ethereum Meetup held in Miami.

Gavin Wood coined the term “Web 3.0.”

August 2014

Crowd sale of Ethereum raised $18MM in bitcoin fund the project.

August 3, 2014

Tezos: A Self-Amending Crypto-Ledger Position Paper L.M Goodman (“Tezos truly aims to be the last cryptocurrency”)

“Laissez faire les propri´etaires.” — Pierre-Joseph Proudhon

Laissez faire les propri translates to “Let the owners do it.” I think hopefully most of us know the ideology behind Laissez Faire. What’s interesting to me is that this quote is by Pierre-Joseph Proudhon, who is said to be the first anarchist.

Proudhon was an anti-capitalist and a proclaimed socialist in his time. He believed the idea of property was theft. As quoted from wikipedia -> When he said “property is theft”, he was referring to the landowner or capitalist who he believed “stole” the profits from laborers. For Proudhon, the capitalist’s employee was “subordinated, exploited: his permanent condition is one of obedience”.

I can’t seem to find the actual quote “Laissez faire les propri´etaires.” on the internet, let alone it being authored by Proudhon. Not to say it’s inaccurate, but the quote seems contradicting to his ideologies.

Ultimately his ideologies seem counterintuitive in comparison to Tezos’s, although laissez faire seems to align. What are your thoughts behind this?

Proudhon also said “property is liberty.” He’s an interesting paradox of a guy. You can play it safe and just call him a very dialectical thinker. I’ve read some of his work (his back and forth with Bastiat is great just for the matchup alone) but have never come to some sort of fixed idea for him like I have for Stirner, Bakunin, Molinari, et al.

Proudhon significantly changed his views towards the end of his life and adopted much more proprietarian views. It’s double fun to quote Proudhon then because they are good quotes and it peeves those who supports his earlier work.

Another Proudhon quote is:

La taxe n’est pas répartie en raison de la force, de la taille, ni du talent : elle ne peut l’être davantage en raison de la propriété. Si donc l’État me prend plus, qu’il me rende plus, ou qu’il cesse de me parler d’égalité des droits ; car autrement la société n’est plus instituée pour défendre la propriété, mais pour en organiser la destruction. L’État, par l’impôt proportionnel, se fait chef de bande ; c’est lui qui donne l’exemple du pillage en coupes réglées ; c’est lui qu’il faut traîner sur le banc des cours d’assises, en tête de ces hideux brigands, de cette canaille exécrée qu’il fait assassiner par jalousie de métier.

My rough translation:

The tax burden isn’t shared in proportion to strength, height, or talent: it cannot be in distributed in proportion to property either. If the State takes more, let it give me back more, or let it stop talking to me about “equal rights” ; for otherwise, society isn’t formed to defend property but to organize its destructions. The State, through proportional taxation, becomes a gang leader. It sets and example by looting on a set schedule; it is the State that needs to be drawn on the accused bench, ahead of these hideous robbers, of the hated scum that it kills by professional jealousy.

2015

the person doesn’t think well because the mind is on strike, but perhaps if the labour conditions were changed for that mind, maybe it would cease to be on strike? It would accept the environment. - John F Nash Jr., 2015

The Moral Character of Cryptographic Work

July 30, 2015

Launched Ethereum from an office in Berlin, Waldemarstraße 37A.

The Pyramid of Ethereum. Ethereum is not decentralized. It has a pyramidal ruling class and can never be considered a neutral currency.

September 2015

CBDC - https://en.wikipedia.org/wiki/Central_bank_digital_currency

August 1, 2017

Bitcoin split After a sequence of historical uploads, some miners and startups decided to separate the original developers creating what was called the hard fork. Bitcoin became Bitcoin Cash and Bitcoin Core, Bitcoin Classic, and Bitcoin Unlimited were born. Throughout the year, bitcoin did not stop marking historic highs, exceeding $ 3,400 per coin on August 7 and a total value of 5 billion. This separation did not appear to have damaged confidence in the currency but rather to strengthen it.

2018

Tezos was the first liquid PoS system to launch when it did so in June 2018. An earlier and smaller PoS implementation is used in Nxt (cryptocurrency and payment network launched in 2013). PoS solves the energy problem in PoW as “work” (i.e. use of energy through computational power) is not the proof requested.

The Avalanche protocol is a robust consensus algorithm, with proofs of its Byzantine Fault Tolerant (BFT) properties. It has different properties than Proof of Work (PoW), which makes it suitable to be used as a complement to PoW. Using both algorithms where they are strongest would allow Bitcoin Cash to enjoy the benefits of both Avalanche and PoW.

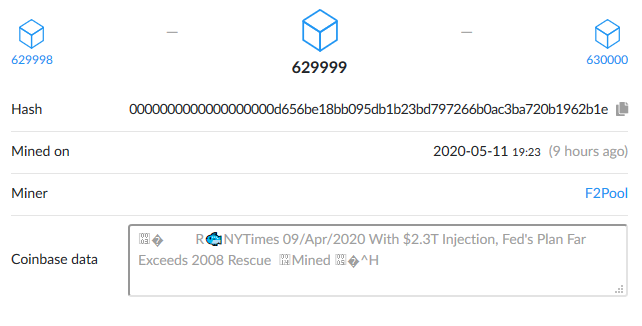

May 12, 2020

Ad infinitum.

May 24, 2019

PolkaDAO is live!

July 16, 2019

Announcing the Kusama Network

March 2, 2020

La justice française assimile le bitcoin à de la monnaie. Pour le Tribunal de Commerce de Nanterre, le bitcoin est un actif incorporel fongible. Une décision importante qui devrait faciliter les opérations en bitcoin et assurer une meilleure liquidité du marché.

Les décisions de justice concernant les cryptomonnaies sont si rares qu’elles méritent attention dans un univers en voie de régulation. Mais la décision du Tribunal de Commerce de Nanterre, en date du 26 février, et révélée par « L’Agefi », fera date à double titre : c’est une première en France, d’autant plus qu’elle sort de la jurisprudence habituelle. Surtout, elle permet de qualifier la nature juridique du bitcoin, la plus célèbre et ancienne cryptomonnaie.

Crypto Now Officially Seen as Financial Instruments in Germany.

2020

May 26, 2020

Zug, Switzerland – Web3 Foundation today launched the initial version of Polkadot, a sharded protocol that allows decentralized blockchain networks to operate together, seamlessly and at scale. Polkadot gives peer-to-peer applications, organizations, businesses, economies – entire digital societies – the agency required to form, grow, govern themselves, and interact without the need for the centralized institutions that we are forced to place our trust in today.

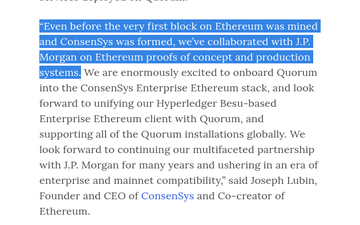

Federal Reserve Board Chairman Jerome H. Powell provided a statement on May 28, 2020, regarding the suitability of AMERIBOR as a replacement to LIBOR. AMERIBOR uses a permissioned version of Ethereum blockchain to capture the interbank lending rates.

The written statement dated May 28, 2020 was in response to a “question for the record” from Senator Tom Cotton (R-AR) following Chairman Powell’s testimony to the U.S. Senate’s Committee on Banking, Housing, and Urban Affairs held on February 12, 2020. Senator Cotton asked if the Fed supports alternative benchmark interest rates besides the Secured Overnight Financing Rate (SOFR) – such as AMERIBOR - for the replacement of LIBOR.

Chairman Powell further stated in his letter, “AMERIBOR is a reference rate created by the American Financial Exchange based on a cohesive and well-defined market that meets the International Organization of Securities Commission’s (IOSCO) principles for financial benchmarks. While [AMERIBOR] is a fully appropriate rate for the banks that fund themselves through the American Financial Exchange (AFX) or for other similar institutions for whom AMERIBOR may reflect their cost of funding, it may not be a natural fit for many market participants.”

Nevada bill would allow tech companies to create governments

CARSON CITY, Nev. (AP) — Planned legislation to establish new business areas in Nevada would allow technology companies to effectively form separate local governments.

Democratic Gov. Steve Sisolak announced a plan to launch so-called Innovation Zones in Nevada to jumpstart the state’s economy by attracting technology firms, Las Vegas Review-Journal reported Wednesday.

The zones would permit companies with large areas of land to form governments carrying the same authority as counties, including the ability to impose taxes, form school districts and courts and provide government services.

The measure to further economic development with the “alternative form of local government” has not yet been introduced in the Legislature.

“Bitcoin may be the TCP/IP of money.” – Paul Buchheit (Creator of Gmail)

2021

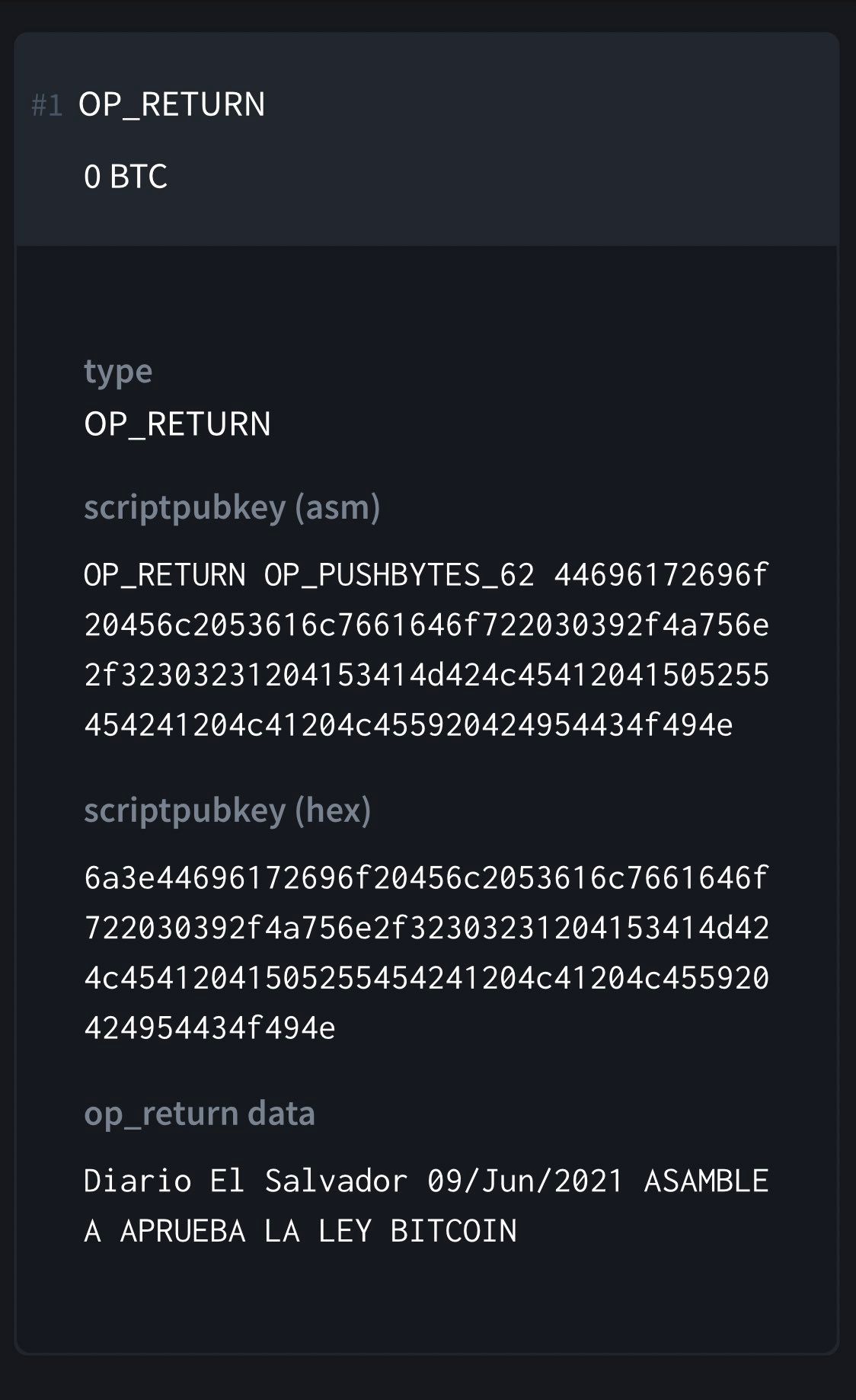

Block 666666

Bitcoin has made the Nigerian currency useless and valueless.

El Salvador announced that they will make Bitcoin legal tender and have bitcoin in their reserves.

Tibetan woman in Sichuan, China salvaging Bitcoin mining machines as the government bans their use for economic freedom — the cords forming a bouquet.

2022

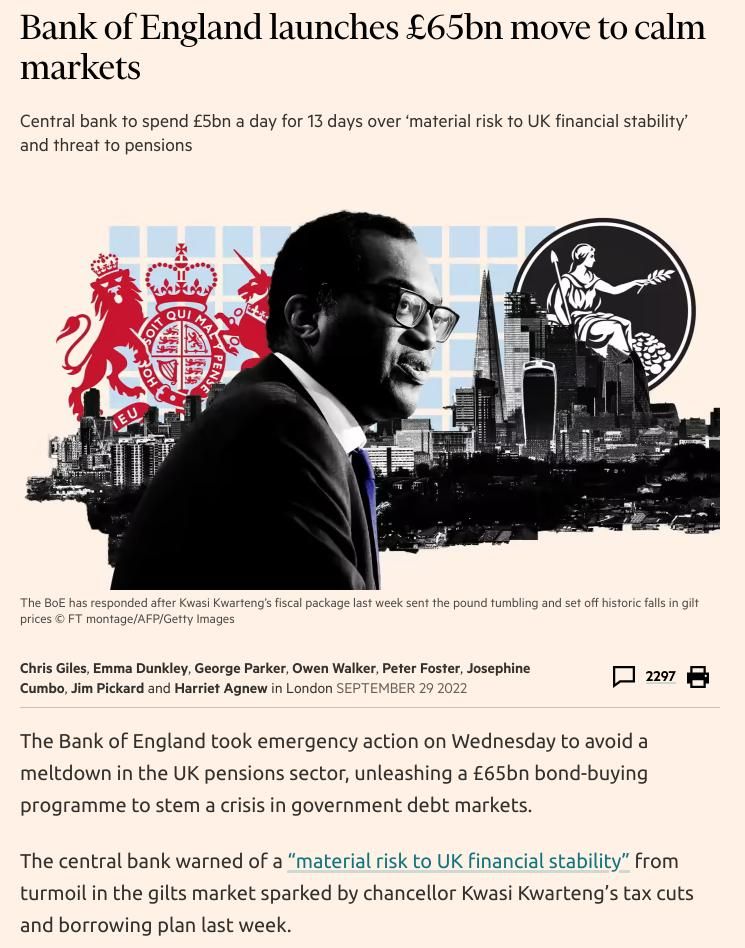

Turkey, no comment.

It’s fiduciary system, it’s all faith based (…) you gotta have confidence in that currency, in that dollar, cause there’s nothing back in there.

We are living through the endgame of fiat currency. Things are only going to get crazier.

When money dies democracy takes the form of populism, with mass social unrest inevitably leading to wide scale revolution.

I fear Bitcoin is often used for illicit finance - Treasury Secretary Janet Yellen

Domestication is a process of animal exploitation where the strongest & most aggressive members of the herd aren’t allowed to project power or multiply. Over time, this makes the herd soft, docile, & ripe for slaughter. Aurochs become oxen/cows, boars become pigs, junglefowl become chicken. Wolves become dogs and begin to depend upon and worship their masters.

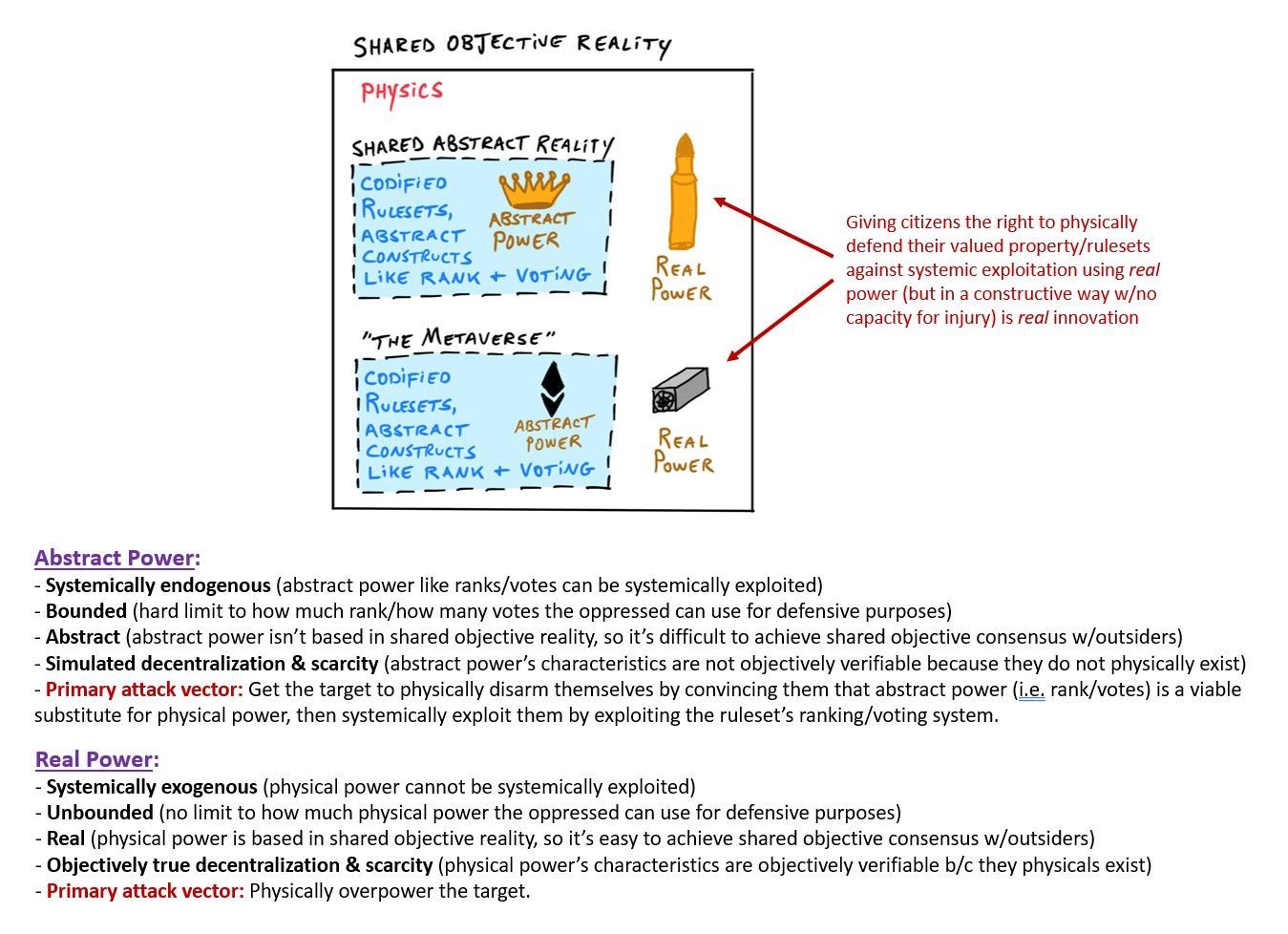

Since the Upper Paleolithic era, sapiens have been using their affinity for abstract thinking to exploit other humans. Shamans wielded abstract power to gatekeep their tribe’s access to the afterlife tens of thousands of years before God Kings did. The main thing which changed during the Neolithic age (aside from domestication of animals) is that people learned how to write down their abstract thoughts into mathematically discrete rulesets after they figured out syntactic language. This enabled Neo Shamans to scale their abstract power far higher than they could have done it using only word-of-mouth.

The result? Millenia of systemic abuse and enslavement as Shaman after Shaman used their abstract power to domesticate their populations and systemically exploit them throughout the Neolithic age and well into Enlightenment. Sapiens only recently figured out that the solution to systemic exploitation is to wield real power to make it too physically cost prohibitive for people to systemically exploit the rules (which we now call laws). Unfortunately, the side effect of using physical power to escape from domestication, enslavement, and systemic exploitation has meant a lot of war, death, and destruction over the past several thousand years.

This is why #Bitcoin is so special… it’s the first time sapiens have figured out how to wield real power to physically defend their property/rulesets against systemic exploitation WITHOUT having to cause physical injury to each other. Other “cryptocurrencies” which use “more environmentally friendly” defense systems like rank/voting systems are not innovative, they are regression back into the same demonstrably exploitable system we’ve been using for centuries, just with different Neo Shamans at the top of the ranks.

For the sake of practicing basic adversarial thinking skills and not allowing yourself to be domesticated, pay attention to those moments when people claim that rank/voting is a viable defense substitute for real power. These moments should raise major red flags.

US federal agencies are moving to zero-trust arch. and post-quantum crypto.

2024

---

having intrusive thoughts about trickle down economics

~2035

this is the age of community: you either join or build something bigger than yourself or you struggle 🤷

People ruled by rules. - Cleisthenes 2.0

The sovereign individual and world wide modern communism, technofeudalism.

The good news is that the Information Revolution will liberate individuals as never before.

For the first time, those who can educate themselves will be almost entirely free to invent their own work and realize the full benefits of their own productivity.

Satoshi “gave” us 33 epochs spanning over 130 years to kick start this global monetary revolution. I think even he would be surprised at how quickly Bitcoin has taken over the world. Hyperbitcoinization is well on its way, and yet we are still so early.

Softwar discusses the possibility of nations swapping mass-based (kinetic) defense systems with energy-based (electric) defense systems for physical security and national defense. The idea of using electricity to mitigate the threat of war has been around for over a century, with Nikola Tesla and Henry Ford proposing their own theories on the matter. Lowery suggests that their ideas could be combined and implemented through an open-source “softwar” protocol that utilizes the global electric power grid and existing internet infrastructure. This new form of power projection technology could empower every nation to physically secure their interests and potentially reduce casualties associated with traditional kinetic warfighting. The author explores the idea that perhaps this electro-cyber warfighting technology already exists and is being adopted by nations, but people don’t recognize it yet because they think it is only a peer-to-peer electronic cash system.

Bibliography

Coffee time

Dear Reader, if you think the article is valuable to you and you want me to drink (and keep writing) high quality coffee (I do like it), feel free to buy me a cup of coffee. ⚡